There is a surfeit of “good news” pouring in. The recession, if ever there was one, is thankfully coming to an end, and we no longer have to stand with our hands outstretched, waiting to catch the sky as it falls down.

Let us sample some of the news :

- Paul Krugman (New York Times) :

[quote]Averting the Worst : The economy has backed up from the edge of the abyss, with the government’s stabilizing role preventing a replay of the Great Depression. (August 10, 2009)[/quote]

[quote]ANALYSIS – Euro zone likely to exit recession in Q3 (August 14, 2009)[/quote]

[quote]Germany, France out of recession (August 14, 2009)[/quote]

[quote]Fed views recession as near an end (August 12, 2009)[/quote]

Please allow me to place a few points :

One, “A replay of the Great Depression has been prevented.”

Paul Krugman, whom I highly admire, correctly notes that a replay of the Great Depression has been prevented.

How accurate is it to compare the intensity with a historical precedent? Our threshold of forbearance now, is significantly lower.

The Eurasian plague of the fourteenth century (also known as Black Death), eventually departed. But an unfortunate 75 million people had fallen to it before that. And the disease was not even as worldwide as our swine flu is. Today’s pandemic records show that 2,123 people have succumbed to the H1N1 virus. A very sad and disturbing fact indeed, but one that would have caused hardly a murmur in the pre-world war days.

The Great Fire of London in 1666, destroyed a good 85% of the London residences!

My point is, today if, god forbid, there is a fire in London which destroys 85 buildings, the scale of havoc would be tiny as compared to the original fire. But to our collective consciousness, it would be equally devastating.

So to rejoice that the current depression is not a replay of the Great Depression, would be akin to rejoicing that the current swine flu pandemic is not a replay of the plague. Okay, there is some stretching the concept, but still, you get the point.

Two, “Times are good compared to same period last year.”

Any comparison with last year’s data is practically null and void. Year 2008 was so singularly disruptive that comparing current year’s data to it is not just plain ridiculous, it is stupid. It would be like a newspaper headline screaming that crude oil prices have halved. Well, compared with last year’s (13 months back – to be precise) data, this is correct.

Car sales in Gujarat in Feb 2002, had shot up manifold over the previous year. But that was hardly the reason to uncork the bubbly. Feb 2001 was the month following the Gujarat earthquake, when car sales were literally non-existent all over Gujarat.

So any comparison should be made with comparable data, which I would say is of two years back – for economic indicators.

The same holds true for decreasing figures too. Developers may claim that property prices have fallen by a steep 20% as compared to last year. But last year was year-before-last plus 100%! So the judgement regarding the value-for-money quotient of a property can be taken only after comparing with the price three years back, and allowing for a reasonable degree of appreciation.

Three, Oh, to find a fact in these feel-good reports…

I have studied so many of these feel-good reports with a fine-tooth comb. Either I am dumb, or I just do not get the point. These reports are continually referring to other reports that the economy has turned around. I am trying to unearth the originating reports, but it is as fruitless as trying to get to the origin of an SMS rumour.

What is causing the journalists and policy makers to celebrate? Well all I could uncover was that the economy has gone down, but less than expected. People have been thrown out of jobs, but again the rate of increase of loss of jobs is stabilizing. (Do you get that?) A survey of CEO’s shows that confidence is coming back. (On what basis?) The US government’s huge subsidy program of Cash for Clunkers is causing a revival in car sales. (A great way to get consumers who have already postponed their purchases, to prepone. What happens when the subsidy is withdrawn?)

As a wise voice said : It seems “less bad” has become the “new good.”

Paul Krugman, after thumping out a cheery headline which eager journalists all too readily rushed to put down in the next morning’s papers, then says “We haven’t yet reached the point at which things are actually improving; for now, all we have to celebrate are indications that things are getting worse more slowly.” He ends his article ‘crediting’ big-government for it’s positive role, and says “We appear to have averted the worst: utter catastrophe no longer seems likely.”

Come on, say cheers. Swine flu no longer seems likely to become as lethal as the black plague.

Four, Ok, So here are the facts… well at least some of them.

Are we missing a few points here? Are some facts being buried in the race to splash front pages with feel good stories?

The USA has lost 6.7 million jobs since December 2007. The economy reportedly, now has the same total no. of jobs that it had in the year 2000. Whereas the labour force has increased by a whopping 12 million since then.

More than five million have been jobless since 6 months or more. This is the highest ever recorded. The percentage of men who have productive employment is the lowest since accurate records are being kept – that is since the year 1948!!!

The jobless rate in USA at 9.4% is crushingly high. No one doubts that. However, that doesn’t stop policy makers and journalists from celebrating the 0.1% reduction since last month. They forget, that this reduction happened, not because people found jobs, but because last month alone, 450,000 people lost all hope of finding a job, and gave up looking for it. So they were no longer considered as unemployed!!! If they had not been so kind as to leave the queue, the unemployment rate would have risen still, instead of falling. As things stand now, the no. of people in employment today, is lower than the no. of people in employment last month! If you add the figures of (i) those who are officially unemployed and looking for a job, (ii) those who are unemployed and would work if offered a job, and (iii) those who are currently doing odd part-time jobs for want of a job, the figure would come to 30 million i.e. 19% of the overall workforce. Now, this is catastrophic.

Five, Are we looking at the right indicators?

Are we trying to take a call on Mumbai’s quality of life by looking at the internet photographs of Mukesh Ambani’s new house (if it can be called a house, that is)?

Would we be celebrating the “resurgence” of the economy, if all the economic indicators were as they are today, but with one exception – the stock market still at March 2009 levels? Would that one indicator matter so much? For the wealth-effect, yes. For increasing company’s ability to borrow money, yes. But still…

Commodity prices are up. This has been a big boost to optimism. Should it be? If rains and production worldwide would have been excellent, then commodity prices would have been lower. This would have made life easier for the recession-hit millions. (Yes millions. The figure includes the IIM grad who had to settle for a measly six figure salary at a desi company, instead of getting a chance to s_____ things up at Lehman Brothers.) But the irony is that the increased commodity prices are good for economists (Is it not, Mr Krugman?), as it increases the GDP figures – the prime criterion for judging the health of the economy. For that matter, do you know that Hurricane Katrina was great for the US economy, as all the re-building really boosted the GDP figures.

Six, “Boo hoo… Where’s my free lunch, mom?”

The USA has had a great ride (as per most, though I beg to differ) till now. What the banking industry is for Switzerland, the printing industry is for USA. They have a unique process by which, a sheet of paper is inserted in a machine, a greenish tinge is added, you print the words – In God We Trust (then why did you attack Iraq? ok, just joking), and presto – you suddenly get a shower of printed pieces of paper called “dollar bills” which the whole world clamours for – and is willing to give Americans ‘real’ stuff like clothes ‘n’ food ‘n’ toys and so on, in return for.

Switzerland gets a similar free ride on the back of its banking industry. Its GDP is 500 billion US dollars. The “private” funds it manages for non-Swiss people is 5.5 trillion dollars. Of course not all of it is “bad” money. Just 99.99% of it.

But the Swiss formula and the US one differ in one significant aspect. Whereas the Swiss get to keep the profits on the near-zero interest funds they get, and also of course the whole principal after the bugger has died and his relatives have stopped searching for the elusive “Swiss Bank Number”, the Americans are mere plodders. Of course, there is some real money here and there for them e.g. the profits on the iPods, plunder money from Iraq (minus cheques written out to Halliburton and KBR) and so on. However, for the most part, all the dollar bills printed at Fort Worth, Texas, are merely IOUs which the government is honour-bound to honour.

Today these IOUs around the world (better known as Eurodollars) far exceed in quantity the dollars held by Americans themselves.

Now imagine a scenario wherein holders of dollars from around the world, start converging on USA demanding some real stuff in exchange for these IOUs. Countries holding dollars find themselves in a Catch-22 situation. They cannot sell them for fear of devaluing their own paper holdings. However, it is not difficult to see that they will be loath to keep on padding up their reserves with dollars. But then, if they do not, then who will fund the great American Dream. Uncle Sam requires to borrow $1017 billion dollars a year (that was in 2008) to keep himself going. (By the way, that’s a trillion dollars with some rounding error. A cool figure and easy to remember. I wonder what the figure for 2009 will be – including the government bailout money used for multi-million dollar bonuses.) That was way over the 460 billion dollars debt amassed in 2007. However, to be charitable to the Great American Dream, we should not forget that 2008 was a leap year. That necessitated funding an entire extra 24 hours. So, the daily figure comes to 2.78 billion dollars. As they say, a billion here, and a billion there, and very soon, you are talking of real money!

Now the question arises, with so many IOUs already floating around, let alone redeeming the existing dollar promissory notes, how is USA going to raise an additional 2.78 billion dollars every day?

Now without this free money slushing around, and homes having ceased to be ATMs, and people suddenly realizing the virtues of saving, what is going to happen to the unbridled consumerism of the Americans? Remember, the world did not pay obeisance to Uncle Sam because he is rich – Sweden and Switzerland are vastly richer; not because of his personal bank balance – see China and Japan; not because the dollar is the de-facto world currency – that merely gave the Americans a license to print notes and commit harakiri on their manufacturing industry; not because of his military prowess – unless you are an Arab sheikh and need to pay protection money to the local dada.

The world kneels down, essentially in deference to the American consumer – who guzzles goods from around the world, and is savior of the world. Just as Goddess Kali guzzles demons, and is savior of the world.

Well guys, the party has just ended, and it is not starting again anytime soon.

Seven, Wait, after reading what follows, will you brand me too a socialist?

What about equality of wealth? As we move forward, we are going to see a steeper inequality. The hyper rich, particularly those with the means to influence governments and create cartels, are going to do splendidly. Profits will increasingly be appropriated on these basis. This layer has realized that if demand falls by 10%, but if industry as a whole cuts production by 20%, it can still get to paste a smiling CEO’s face in the newspaper article analyzing its results for the year. The oligopolies created in the past few years, will aid this trend no end.

The layer below that will have to struggle, but will still pull along fine, thanks to inflation and its benign effect on value of stocks. The salaried class are going to find the going much tougher.

A good indicator of an economy is the risk premium presented to entrepreneurs by the economy. I.e. suppose a person is doing a moderate job. What would a person of similar skills and aptitude make as an entrepreneur. That is to say, if he neither goes bust, nor proves to be the next Dhirubhai Ambani, how much more is he normally earning. That is the risk premium he is getting. Now of course this is very difficult to quantify. The initial basis of “similar aptitude” itself is open to question, as an entrepreneur can be expected to have a very different aptitude. Also, we cannot consider the vastly above-average people in either group – neither Chanda Kochhar (ICICI Bank), nor Kunwer Sachdev (Su-Kam). Also, public sector jobs, would be excluded. This whole stuff is difficult to quantify – yes. But that does not mean that it can be considered zero, or worse still, considered unimportant.

I am sure you will agree that the ratio of income of entrepreneur to salary-earner was significantly skewed in favour of the former during the license raj days of Smt. Indira Gandhi.

In the five years of BJP / NDA rule, it progressively shifted, so that the salary-earner was far better off than before. (And BJP is called the trader-bania party. Talk about irony!) In the coming three years, this is again going the Indira Gandhi way. It will be far better to be in business, than a regular qualified guy looking for a job.

What is good for the economy? for the nation? What ratio is ideal? This is difficult to pinpoint, however, common sense dictates that either of the two situations, where a person, even though well qualified, cannot get a decent earning job; or at the other end, if an entrepreneur only makes as much as relatively risk free job; is not exactly conducive to my idea of an economy in a good shape.

If job-seeker’s bargaining power is going down, it means that merit is no longer commanding a premium as before. It means that success of an enterprise in the economy is currently more dependent on top level machinations rather than ground level people with merits. It means that though business activity as measured by GDP is fine, it is being concentrated in fewer and fewer hands; so that a corresponding demand for talented hands is not growing. And of course, it means that industry does not need more people, as it is not having adequate plans for growth.

Eight, …and don’t forget…

USA’s healthcare system is in such a mess, it’s stink makes me reach for a face mask. Will this affect the world economy? You bet. And far more insidiously than anyone may care to think.

Nine, “But India is fine, isn’t it?”

That’s what the CNBC ‘experts’ said when the Sensex was scaling 20000 and US economy had started tanking.

Well what of India? I will just pen a few thoughts on the state of affairs.

The current level of corruption at high places is the highest ever since independence, and maybe the highest ever since before that also.

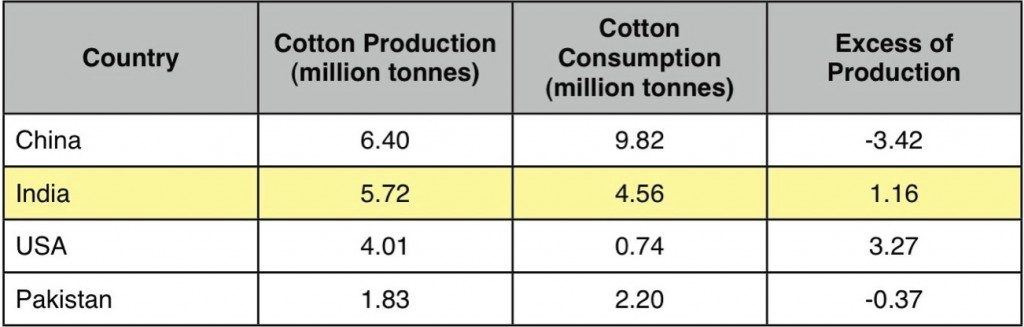

Even industrialists are re-learning the tricks they partly forgot during the NDA rule. Reliance Industries is, with impunity, creating artificial shortages for its products in spite of the demand being normal. The rate for polypropylene, till recently, was quoted as printed price list plus say twenty rupees “on”. Ditto, for many other goods on which it has a vice like hold. (No wonder, its results showed worse than expected profit margins.) Grasim gets imports of viscose fibre stopped by subjecting them to anti-dumping duty. Oligarchs are seeing the virtues of rigging up prices by curtailing production. Agricultural product markets continue to be rigged by the agriculture minister Sharad Pawar. Dayanidhi Maran continues the good work of his predecessor Shankarsingh Vaghela. Tens of thousands of crores of cotton stock rots in godowns of NAFED and CCI, so that prices can be rigged up artificially, for the cotton traders to be able to make a killing. This is of course without regard to the net cost on the country in terms of lost production and lost opportunities for export of the finished goods, as our raw material cost vis-a-vis global prices, previously a strength for us, now becomes a noose around the neck of the industry.

India’s fiscal policy is at its worst ever. Last year, our venerable finance minister asked RBI for a lac crore (how do you put it in millions?) This year, he has asked for four lac crores. (In indian currency, thank god). The government is bent on handing out free lunches like there is no tomorrow. Much of it hides inherent corruption by its cronies. All of these costs are going to come back to haunt us.

After the Jalianwala Bagh massacre, a British newspaper, The Morning Post, started a sympathy fund for General Dyer and collected over £30,000. That was journalism at its worst. But for this action by the Morning Post, this epithet (journalism at its worst) would surely crown today’s journalists, media and news channel barons.

As the power coterie’s brazen corruption emboldens it to throw crumbs at the fourth estate, its sins are magically washed away. Trying to find evidences of its blunders is impossible by reading the mainstream media. And the BJP media cell has gone numb, clearly outflanked outmaneuvered and out-of-pocket-money.

Looking to all of the above, the Nifty on 15th August 2010 at 2 pm, will be …

I do not predict a doomsday scenario.

When car sales tanked last year, and people were predicting the demise of most car companies, a wise man reported that if the current rate of car purchases by people was taken as given, it means that a user will replace his car on an average in twenty five years.

My purpose in writing this blog post is not to say that the world is coming to an end. It is merely to predict harder times ahead. And a world striving to float its way to a stable economic scene – where production and consumption and prices are governed and nudged along by natural forces, like say people’s propensity to save or spend; and not buffeted by the artificial drafts of free credit / free money.

So what’s the effect to be on the share market. Search me.

The first thing to remember is that the share market is hardly an indicator of the health of the economy. At best, the Nifty is a rough indicator of the health of the fifty companies which make it up. These companies cumulatively represent barely a small fraction of 1% of the country’s trade and industry. Profits will flow to those amongst them who can influence the powers that be, and those who have their consumers at their mercy. To the extent that they choose to show these profits on their books, their results will look better.

Also, the farming populace / public sector employees are certainly better off. At least for the time. The NREGS (rural employment guarantee scheme) was a smart move by the Congress. Largesse to farmers and pay commission awards may be a burden to the economy, but as consumers they will certainly come to the aid of the industries which serve them.

The positives, will of course, be hampered by the spectre of drought.

The End (thank god!)…

To close, I would like to point out what I believe are some numbers to look for while judging the state of the economy.

What are reliable indicators :

- What is the starting salary of an average engineering college graduate? What is the percentage on-campus recruitment?

- Shipping freight rates as compared to the rates two years back.

- What is the rate of growth of advertising?

- What is the sum total of all retail sales as compared to last year? This has to be adjusted for inflation on the retail level. Say, the retail sales data shows a growth of 5%, but inflation for the consumer (considering his basket of retail purchases) is 7%, then effectively, there is a sales dip of 2%.

What are NOT reliable indicators :

- No. of newspaper headlines stating that the recession is over.

- Sensex / Nifty et all.

- Inflation / deflation figures.

- Profit figures of Goldman Sachs. Not even the bonuses paid.

All in all, let’s hope the Indian never-say-die spirit wins over the imbecility of our rulers, and the greed of our media barons, as we work our way towards a better dawn.